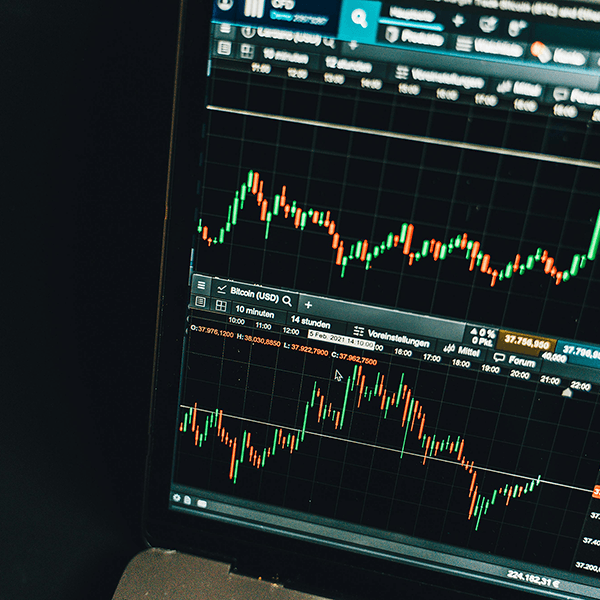

On October 9, 2025, the average 30-year fixed mortgage rate edged slightly higher to 6.38% after a weaker 30-year Treasury auction and mild MBS underperformance. Rates remain stable within a narrow range as the government shutdown continues.

Published on 10/10/2025

The mortgage market is always shifting, and this week brought a mix of economic news and government updates that could impact buyers and homeowners. Here’s a quick look at what’s happening and how it might affect you.

Published on 10/03/2025

On October 1, 2025, the average 30-year fixed mortgage rate held at 6.37% after weak private payroll data. Bigger shifts may follow when the delayed government jobs report is released.

Published on 10/01/2025

The mortgage market saw a little bump this week, but the big picture remains encouraging for buyers and homeowners considering a refinance. Here’s what’s happening in the news — and why it matters.

Published on 09/26/2025

Affordability is finally improving this fall thanks to lower average 30-year fixed mortgage rates, slower home price growth, and rising wages. Learn why now could be the right time to buy.

Published on 09/26/2025

The Fed cut rates by ¼% this week — but mortgage rates didn’t drop. In fact, they ticked slightly higher right after the announcement. Here’s why: mortgage rates move based on market expectations, not the Fed’s overnight rate, and the cut had already been priced in. Learn what this means for buyers and homeowners, plus why now may be a smart time to review your refinance options before our 10/1 pricing incentive window closes.

Published on 09/19/2025

After touching yearly lows early in the week, the average 30-year fixed rose following the Fed’s rate cut—thanks to the dot plot and Powell’s comments. Still, mortgage applications just saw their biggest weekly jump since 2021 as homeowners reacted to earlier rate declines. Here’s what it means for buyers and homeowners.

Published on 09/19/2025

The average 30-year fixed is holding near the lowest levels since October 2024 after a weak jobs report and cooler inflation. Here’s why—and what to watch at next week’s Fed meeting.

Published on 09/12/2025

Mortgage rates are holding near 10-month lows—but don’t assume they’ll stay there. Learn why rates move, what drives them, and what smart buyers and homeowners should do next.

Published on 09/03/2025